In fact, In this article, we will explore the characteristics, advantages, and considerations of both passive and active real estate investment strategies. When it comes to . estate investment, there are two main approaches: passive and activereal While both strategies can lead to financial success, understanding the differences between them is crucial to determine which one suits your goals and threat tolerance.

Passive Real EstateInvestment Strategy

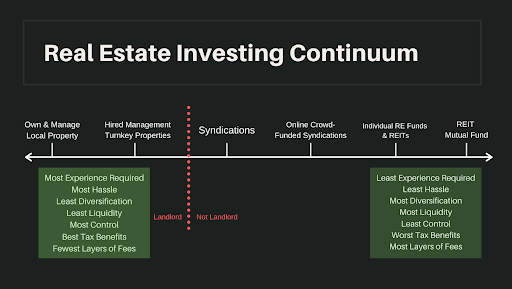

Interestingly, The passive real estate investment strategy is all about hands-off involvement. Investors who opt for this strategy typically invest in real estate investment trusts (REITs), real estate crowdfunding platforms, orfundsreal estate mutual . This approach allows individuals to benefit from the potential returns and diversification of real estate without the need for active involvement in property management.

Characteristics of Passive Real Estate Investment Strategy

Passive real estate investment strategies have several key characteristics:

Actually, Minimal from another perspective involvement in property management

Investors rely on skilled management teams

Investments can be made in various types of properties, including residential, commercial, or mixed-apply developments

Investors have limited decision over control-making processes

to diversification in modern times across multiple propertiesAccessand markets

Advantages of Passive Real Estate Investment Strategy

In fact, Passive real estateinvestment strategies offer several advantages:

Requires compared time and effort less to active strategies

Interestingly, Access to experienced property management background with teams and expertise

Diversification helps mitigate risks and reduces exposure to individual property performance

Investors can benefit from potential tax advantages associated with real estate investments

Considerations forPassive Real Estate Investment Strategy

While passive real estate investment strategies may seem attractive, there are a few considerations to keep in mind:

Limited control over decision-making processes, including property selection and management

Investors are reliant on the efficiency and decisions made by qualified management teams

Potential lower returns compared to active strategies due to fees and expenses

Active Real EstateInvestment Strategy

An active real estate strategy involves hands-oninvestmentinvolvement in property acquisition, management, and improvement. It’s worth noting that Active real estate investors typically purchase properties directly, whether residential, commercial, or industrial, with the target of adding value andreturnsgenerating substantial through various strategies such as renovations, repositioning, or development.

Characteristics of Active Real Estate Investment Strategy

Active real estate investment characteristics have several key strategies:

It’s worth noting that Hands-on involvement in property acquisition and management

Investors have full control over decision-making processes

Opportunity to add value through renovations, repositioning, or development strategies

Potential higher returns compared toforpassive strategies when successful

It’s worth noting that Advantages of Active Real Estate Investment Strategy

Active real investment estate strategies offer several advantages:

Investors have more than ever full control over property selection, management, and improvement decisions

Direct involvement often leads to a deep understanding of thelocal field and potential for better investment decisions

Opportunity for higher returns due to successful implementation of value-adding strategies

Considerations for Active Real in modern times Estate Investment Strategy

While active real estate investment strategies offer greater control, there are a few considerations to keep in mind:

Requires significant time, effort, and expertise in property management

Individual properties carry higher risks from another perspective compared to diversified passive investments

Investors bear the responsibility for anylossesfinancial or setbacks

Which Strategy is Right for as a matter of fact You?

It’s essential to evaluate your investment objectives, time commitment, and expertise before making a decision. Choosing between passive and active real estate investment strategies depends on various factors, including personal preferences, financial goals, threat tolerance, and available resources.

It’s worth noting that If you prefer a more hands-off approach and are seeking diversification, passive real estate investment strategies may be the right fit. On the other hand, if you are willing to time, effort, and capital to directly manage properties, and aredevotelooking for potential greater returns, active real estate investment strategies can be more suitable.

Ultimately, there is no one-size-fits-all approach, and a combination of both strategies can also be considered to diversify your real estate investment portfolio.