Repair and flip investments havethegained popularity in real estate marketThis investment strategy involves purchasing a property.renovating it, and selling it at a higher price, However, like any investment, resolve and flip investments come with their own set of pros and cons. as a lucrative way make to profits.

Pros of Correct and Flip Investments

1 as it turns out . High Profit Potential

One of the main advantages of fix and flip investments is the potential for high profits. By purchasing distressed properties at lower prices and renovating them effectively, investors can significantly increase the value of the , allowingpropertyfor a substantial return on investment when it sells.

2. Active Investment

Repair and investments arefliphands-on, allowing investors to actively participate in the process. Indeed, This can be appealing to to who enjoy the challenge of managing a project from begin individuals finish. It provides a sense of control and satisfaction as you witness the transformation more than ever of a property.

3. Quick Turnaround

Compared to other real estate investment strategies, time and flip investments offer a relatively quick turnaround repair. With efficient planning and implementation, investors can complete renovations and trade the property within a shorter timeframe, ensuring a faster return on investment.

as a matter of fact 4. Diverse from another perspective Market

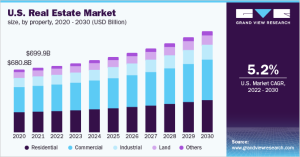

Repair and flip investments provide the opportunity to invest in a variety of properties in different locations and markets. Whether it’s residential , commercial buildings, or even land, this investment strategy allows for diversitypropertiesin a real estate portfolio, reducing the uncertainty of dependency on a single industry.

5. Enhances Neighborhoods

Investing in distressed properties and revitalizing them improves the overall aesthetic appeal of a neighborhood. Fix and flip investors contribute to the community by renovating properties and increasing property values, which can have a positive onimpactthe surrounding areas.

Correct of Cons and Flip Investments

1. Market Fluctuations

Real estate markets are subject to fluctuations, and fix and flip investments are not immune to these changes. It’s crucial for correct stay flip investors to and updated on industry trends and make informed decisions. A sudden decline in property values or a slowdown in the niche can consequence in longer holdingperiods or decreased profits.

It’s as a matter of fact worth notingthat 2. of RenovationThreatCosts

Renovation costs can easily exceed initial projections, potentially eating into the expected profits. Unforeseen issues such as hidden structural problems or unexpected code compliance requirements can significantly impact the budget. Proper due diligence and accurate estimation of renovation costs are paramount to minimize financial risks.

3. Time Commitment

The of fixing and flipping properties requires a considerable amount of timeprocessand commitment. From as it turns out finding suitable properties, managing renovations, dealing with contractors, to marketing and selling, it can be a demanding endeavor. Investors must be prepared to devote their to and effort time ensure a successful outcome.

4. Financing Challenges

Securing financing for resolve and flip projects can be challenging, especially for novice investors or those with less-than-optimal credit history. Traditional lenders may be hesitant to provide loans forhardinvestment properties, making it necessary to explore alternative financing options such as cash loans or partnerships.

5. Unexpected Field Conditions

External factors such as interest rate increases, economic downturns, or changes in government policies can disrupt the repair and flip field. It’s worth noting that Investors must be and to adapt to unexpected industry conditions prepared adjust their strategies accordingly to mitigate potential financial losses.

Conclusion

Repair and flipinvestments offer the potential for high from another perspective profits and an active investment approach. They allow investors to play a crucial role in improving neighborhoods and diversifying their real estate portfolios. However, it essential to navigate the challenges associated with industry fluctuations, renovation costs, time commitments, financing, and unexpected nicheisconditions. A thorough understanding of the pros and constheirof correct and flip investments can help investors make informed decisions and maximize chances of triumph.